The Venmo plan of action depends essentially on the assortment of expenses from application clients and shippers. Venmo doesn’t charge clients for its immediate distributed cash moving administrations. Also Check: USD to PKR

All things being equal, the organization brings in cash through exchange charges, withdrawal expenses, check changing out expenses, and offshoot associations. Venmo likewise offers a check card through an organization with Mastercard and a Mastercard through Visa, empowering it to gather exchange charges through traders that get compensated with these cards.

Venmo’s essential rivals are its own parent organization PayPal and Zelle, which is another immediate cash move administration buyers can use to move cash to their loved ones electronically. Zelle doesn’t propose however many exchange choices as PayPal or Venmo, yet it’s claimed by an organization of huge, laid out monetary establishments.

8 Ways Venmo Makes Money

- Pay-With-Venmo Transactions

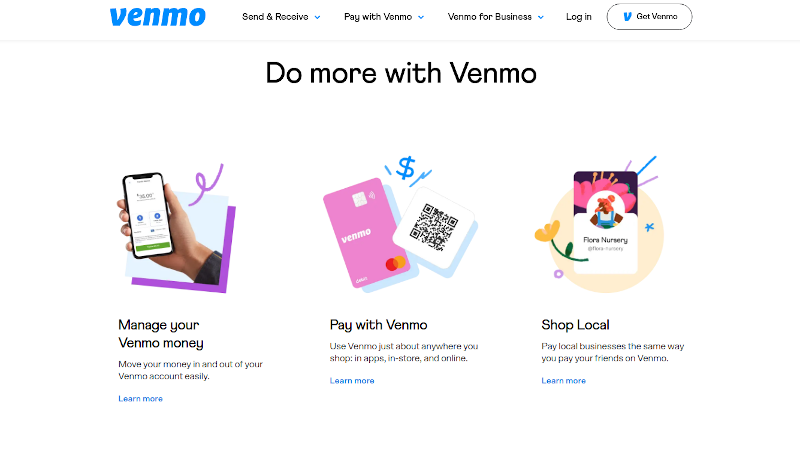

Pay-With-Venmo allows clients to finish exchanges with specific shippers utilizing assets from their Venmo accounts. Venmo charges traders an expense of 1.9% of the price tag on each exchange, in addition to $0.10. Current Pay-With-Venmo accomplices incorporate Uber Eats, CVS, and Hulu.

- Moment Transfers

Venmo clients can utilize Venmo Instant Transfers, a help delivered in 2019 that allows clients in a flash to move cash from their Venmo records to their ledgers. Rather than hanging tight for the one to three work days it typically takes to move assets to a financial balance, Venmo Instant Transfer reserves are accessible in 30 minutes or less.

Venmo brings in cash on Instant Transfers by charging an expense equivalent to 1.5% of the sum moved. Clients should pay a base moment move expense of $0.25 however aren’t charged more than $15 per move. Standard electronic withdrawals are sans still for clients. Also Check: Gold Rate in Pakistan

- Visa Interest and Fees

Venmo offers qualified clients Venmo Visa and Venmo Visa Signature Mastercards. Cardholders pay yearly rate rates ((APRs)) equivalent to the great rate in addition to somewhere in the range of 11.99% and 20.99%, contingent upon the record type. Venmo likewise charges the excellent rate in addition to 20.99% APR on loans, as well as loan exchange expenses and punishment expenses.

- Exchange Fees

As well as charging clients interest on Mastercard buys, Venmo charges dealers trade expenses when clients utilize the Venmo Credit Card to finish those buys. This expense is made out of a level of the exchange esteem in addition to a little level charge.

- Withdrawal Fees

Venmo clients who believe that immediate access should money can utilize a Venmo Debit Card to pull out cash through any ATM. Clients who utilize their charge card for withdrawals pay a $2.50 ATM Domestic Withdrawal Fee and a $3.00 Over-the-Counter Withdrawal Fee while pulling out cash.

- Cash a Check

One of Venmo’s freshest highlights, Cash-a-Check, allows clients to cash their checks and government improvement checks. Venmo charges the client 1% of each and every finance and government really take a look at the sum and 5% on any remaining OK checks. Checks should have a base worth of $5 and a limit of $5,000. To exploit this element, clients should have a checked email address and empower direct store or have a Venmo Debit Card. Also Check: Euro to PKR

- Cashback Program

Venmo charge and Visa holders can bring in money back when they utilize their card to make buys at specific vendors. By offering this arrangement through Dosh, Venmo boosts its cardholders to shop at select sellers rather than different traders. In return, Venmo gets a reference commission in view of the quantity of exchanges and its concurrence with the accomplice.

- Digital currency Fees

Notwithstanding its standard cash move administrations, Venmo brings in cash by charging exchange and trade expenses on the buy and offer of digital currency. The expenses charged on these exchanges shift with exchange size. Also Check: Pound to PKR

For instance, Venmo charges a base expense of $0.50 on all exchanges up to $24.99; 2.3% of procurement or deal sums up to $100, 2.0% up to $200, and further diminishing rates as the exchange size increments. As indicated by Venmo’s site, the conversion standard for cash likewise incorporates a spread that Venmo gets for every exchange.