Scalping Trading Strategy: How Its Works with Pros & Cons

Investing in financial instruments can be a great way of making money in modern times. People’s interest in financial trading is increasing these days due to the possibility of making huge profits. However, many novice traders are confused about the strategies to use for starting trading. In this article, we will learn about scalping trading, a popular strategy, and how to use it.

What is scalping trading?

Scalp trading or scalping is a type of day trading strategy. It is used to take advantage of short-term price movement of financial assets by placing multiple trades in a few seconds or minutes.

The process of opening and closing multiple trades in a short period is known as scalping. The main of scalping is to earn a quick and overall big amount of profit from all small trades together.

Understanding the concept of scalping

Scalping is the most popular and highly profitable strategy used while trading in gold, forex, cryptocurrencies, stocks, minerals, energies, and other financial markets.

Many people confuse scalping with day trading. As in day trading, also traders open and close a trade within a single day, but scalping is not exactly similar to day trading. The number of trades a day trader places is around 1 to 3.

However, a scalper makes 10 to 100 trades daily using different scalping trading indicators such as one-minute charts, real-time ticks, and signals to place a trade.

Traders can place trades manually. However, if you are placing a large number of trades, then you should use an automated trading system to open or close the trade automatically at predefined rules.

The time frame of scalping can be between one to fifteen minutes. However, scalpers generally open a position for one or five minutes to make five or ten pips per trade.

Golden Rules to Implement Scalping Effectively

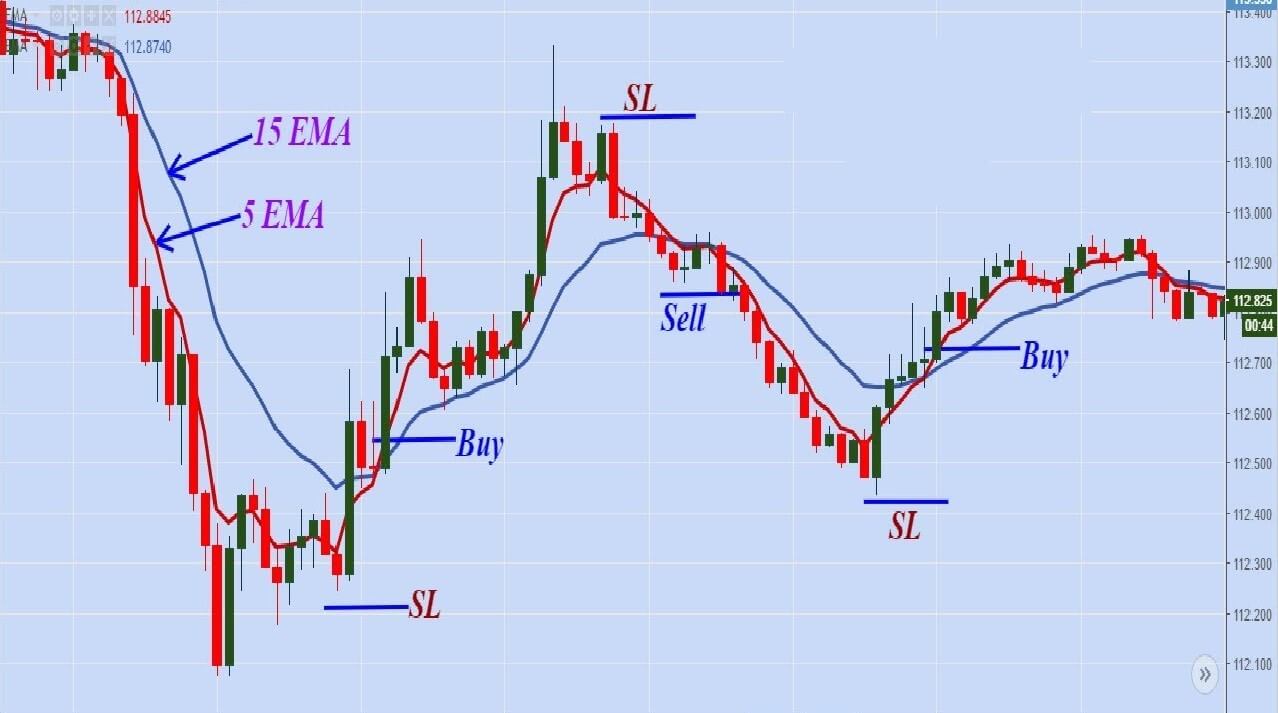

- Focus on reading and interpreting technical indicators Tick, Moving Averages, Bollinger Bands, Stochastic Oscillator, Parabolic SAR, etc., to place trade effectively.

- The key to success in scalping is to master order execution. Have a clear idea of how many trades you will place in a day with their entry, exit, stop loss, and take profit levels.

- Trade the most popular, volatile, and liquid financial assets to eliminate the chances of unexpected price fluctuations.

- Emotional management is one of the must-have skills for a scalper. Avoid trading based on instinct, fear, overconfidence, or greed. Always make trade decisions based on logic instead of emotions.

- Discipline is a must to have the psychological skills of a scalper. Make a journal of your trades and analyze the records timely to avoid making common mistakes.

- Always trade using risk and money management tools. You need to have a clear idea about your risk-to-reward ratio, leverage ratio, capital percentage per trade, and other funds-related information.

- Keep your eye on current market conditions and make changes accordingly. Scalpers should always be careful and fully focused to make quick trade decisions.

Amazing Benefits of Scalping Trading

Limited exposure to Risk: Trading in currencies or the stock market involves significant risk. When a trader places a large amount in a particular trade, the chances of losing money are also huge.

However, scalping is a way to diversify your investment into different financial assets that too in small portions. So you can adjust your losses from a few trades from the profit of some trades.

High & Quick Profit: Scalpers make small profits from multiple trades, so the overall profit amount from all the trades is very high. Also, with strategies like swing trading and position, a trade lasts from a few weeks to months.

However, scalping is the game for a few minutes. All the trades are opened and closed within a day. So you can withdraw your profit at the end of your day. Also, the win rate of scalping is higher than many other strategies.

No need for Fundamental Analysis: The price of crypto, forex, or any other financial products gets affected by fundamental analysis factors like government policies, economic releases, political tensions, news, and announcements.

However, scalping is purely based on technical analysis indicators as traders enter and exit a trade in a few minutes. So you don’t need to watch fundamentals with scalping.

No extra fees: Scalpers don’t have to pay additional costs like rollover or swap fees. Many traders pay these fees for holding a trade overnight but in scalping all the trade is completed within a day.

Limitations of Scalping Trading

Stressful Process Requires Great Concentration: Scalping trading strategy is not as easy as it looks. It requires skills like instant decision-making, concentration, continuous market monitoring, and a strict exit plan to eliminate big losses.

One second of distraction or inactivity may affect the whole results. So, it cannot be an ideal strategy for beginners & traders lacking market understanding.

Over trading: A trader should place a maximum of three to four trades daily. However, scalping is the process of placing multiple trades. Many traders even place more than 100 trades daily but not every trader has the ability to handle such many trades.

High Trading Fees: Scalper does not pay any additional fees, but the trading fees, commissions, or spreads for this strategy are very high. Scalpers make many trades, so eventually, the cost becomes big and may affect your profit.

Time-Taking process: As we have studied above, scalpers, daily, place a large number of trades daily, so it is a time-consuming process. It requires time to monitor charts and indicators continuously.

Also, the knowledge of technical analysis indicators is a must for a scalper. So, traders with jobs or businesses cannot go for this strategy as it requires your attention.

Wrapping Up

Scalping can be a complex process for some people, so before using strategy, first have a great understanding of the market in which you are trading.

Like any other trading strategy, scalping also has some pros and cons. However, careful implementation may result in high profits.

Scalping requires discipline, patience, concentration, speed, knowledge, and analytical skills. It is not suitable for all sorts of traders to implement such a mentally challenging strategy.

However, with the right trading psychology, emotional management, and instant decision-making, it is one best strategies to trade in the financial market. Just keep your focus right and start trading using a scalping strategy in any of the financial assets.